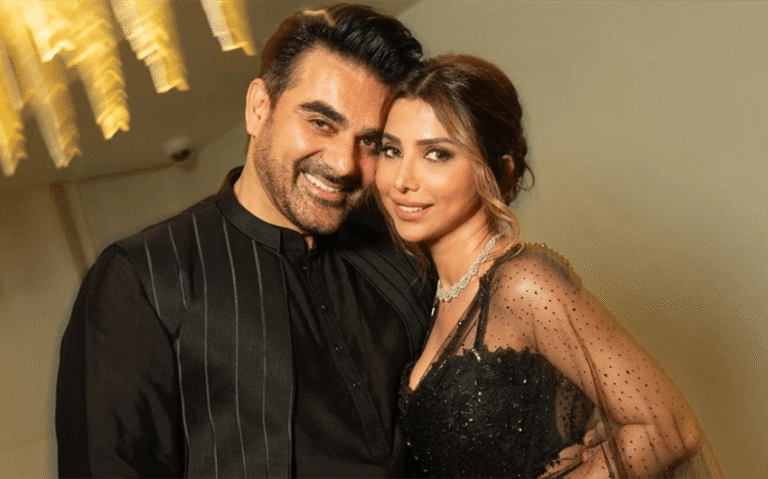

Carter Reum Net Worth In 2026: M13 Ventures Income And Wealth Breakdown

If you’re looking up Carter Reum net worth, you’re probably trying to separate two things: what he’s built on his own versus what people assume because he’s married to Paris Hilton. The honest truth is that Carter’s wealth is largely rooted in ownership—companies, equity stakes, and venture investing—so there’s no single “official” number that can be confirmed like a salary.

Still, based on what’s publicly known about his business background and how venture capital wealth typically works, Carter Reum’s net worth is commonly estimated in the tens of millions—often placed around $20 million to $40 million, with some estimates pushing higher depending on how people value his private equity stakes and fund economics.

Quick Facts About Carter Reum

- Full Name: Carter Milliken Reum

- Known For: Co-founder and partner at M13 (venture capital)

- Former Career: Investment banking (Goldman Sachs background is widely reported)

- Business Exit: Co-founded VEEV Spirits (sold in 2016)

- Book: Co-author of Shortcut Your Startup

- Spouse: Paris Hilton (married 2021)

- Children: Two with Paris Hilton

- Why People Search Carter Reum Net Worth: Venture capital wealth is real, but it’s mostly private and hard to track

So, What Is Carter Reum Net Worth Really?

Think of Carter Reum’s net worth like an iceberg. The visible part is easy: a successful founder, a VC partner, a bestselling business author, and a public-facing spouse of a global celebrity. The hidden part—where most of the money is—comes from private investments and fund structures that aren’t posted on a scoreboard.

That’s why you’ll see ranges rather than a neat single number. In venture capital, your “wealth” can be locked inside equity positions for years. Some of it becomes cash only when a company sells, goes public, or distributes profits back to investors.

How Carter Reum Makes Money

If you want to understand his net worth, it helps to break his income into buckets. Carter’s financial story is less “celebrity paycheck” and more “ownership + investing.”

1) M13 Venture Capital Fees And Carry

Carter co-founded M13, a venture capital firm known for investing in consumer brands and tech. Venture capital firms typically make money in two main ways:

- Management fees: A percentage charged on assets under management (AUM) to run the fund.

- Carried interest (“carry”): A cut of the profits when investments perform well.

Management fees are the steady, predictable income. Carry is the jackpot income, but it can take years to show up. If M13’s portfolio has big wins, carry can dramatically boost Carter’s wealth. If exits are slower in a down market, carry can take longer, even if the underlying investments are strong.

2) Ownership And Equity From VEEV Spirits

Before M13, Carter and his brother Courtney co-founded VEEV Spirits. The company was later sold (reported in 2016). A sale like that can provide a meaningful financial foundation, especially if the founders kept significant equity.

Founder exits don’t always mean “instant hundreds of millions.” A lot depends on deal terms, ownership percentages, debt, and whether payouts were immediate or structured over time. But a successful exit still matters because it can:

- create cash for future investing

- prove credibility with investors

- open doors to bigger deals and partnerships

3) Personal Angel Investments And Equity Stakes

Even beyond M13, Carter is often linked to early-stage investing in well-known companies. Here’s the key point: even a small stake in a breakout startup can be worth a lot later, but you can’t always sell it whenever you want.

That’s why his net worth is hard to pin down. A private equity stake might be “worth” millions on paper, but it may not be liquid today. You can be wealthy and still not have that money sitting in a checking account.

4) Book Royalties And Speaking

Carter co-authored a business book and has spoken publicly about entrepreneurship and investing. Books and speaking usually aren’t the biggest piece of a VC’s wealth, but they do three valuable things:

- add steady side income (royalties, speaking fees)

- expand personal brand (which helps deal flow)

- build authority (which helps fundraising)

In other words, this bucket might be smaller than venture equity, but it strengthens the whole ecosystem that makes the bigger money possible.

5) Real Estate And Lifestyle Assets

High-net-worth individuals often hold a meaningful portion of wealth in real estate—primary homes, investment properties, or long-term holds. Carter’s real estate picture isn’t fully public in a way that allows precise math, but in general, property can quietly add millions in net worth over time through appreciation and equity.

This is also one reason celebrity-adjacent net worth estimates can be misleading. People see a luxurious lifestyle and assume it equals endless cash, when it’s often a mix of assets, financing, equity, and long-term wealth planning.

How Marriage To Paris Hilton Affects His Net Worth

When you’re married to someone as famous (and wealthy) as Paris Hilton, people naturally assume your money is merged into one gigantic number. In reality, celebrity marriages can be financially structured in many different ways, especially when both partners have significant assets and businesses.

What you can say with confidence is this: Carter’s career stands on its own. He was a founder and investor before the marriage became public, and his wealth narrative doesn’t rely on being “Mr. Paris Hilton.” If anything, the marriage increases his visibility, but the underlying wealth engine is business ownership and investing.

Why Net Worth Estimates For Carter Reum Vary So Much

If you’ve seen wildly different numbers online, you’re not imagining it. Carter is a perfect example of someone whose wealth is real but hard to measure because it lives inside private markets.

Here are the biggest reasons the estimates swing:

- Private equity is hard to value. You can’t just look up a stock price.

- Carry is uncertain and slow. Big VC money can take years to materialize.

- Ownership percentages are unknown. People guess his stake in firms and deals.

- Different sites use different assumptions. Some assume conservative valuations; others assume best-case exits.

So when you see a number, treat it as an estimate based on assumptions—not a verified bank statement.

A Realistic Range For Carter Reum Net Worth In 2026

Most public estimates place Carter Reum net worth somewhere in the tens of millions. A commonly repeated range is $20 million to $40 million, though some estimates stretch higher depending on how they value:

- his ownership in M13 and potential carried interest

- the long-term value of M13’s portfolio

- private stakes that may not be publicly disclosed

If venture markets heat up and M13 sees more major exits, his net worth can rise quickly. If exits slow down, the “paper value” might still be high, but the public estimate may look flatter because less becomes liquid.

What People Get Wrong About Carter Reum’s Wealth

When you look at Carter’s money story, a few common misconceptions show up repeatedly:

- Myth: He’s rich mainly because he married Paris Hilton.

Reality: His wealth is primarily tied to entrepreneurship and venture investing. - Myth: Net worth equals cash available to spend.

Reality: Much of his wealth may be tied up in equity and long-term holdings. - Myth: A VC’s AUM equals personal net worth.

Reality: AUM is money the firm manages for investors, not the partner’s personal bank balance.

Once you understand those differences, the whole “Why can’t anyone agree on his net worth?” question makes a lot more sense.

The Bottom Line

Carter Reum net worth is best understood as a venture-capital-and-ownership story. He built wealth through entrepreneurship (including the VEEV exit), co-founded M13, and earns through fund economics, investments, and business media work. In 2026, his net worth is widely estimated in the tens of millions—commonly around $20 million to $40 million—with upside depending on how his private investments perform over time.

Featured image source: https://edition.cnn.com/2021/02/17/entertainment/paris-hilton-engaged